Financial Planning

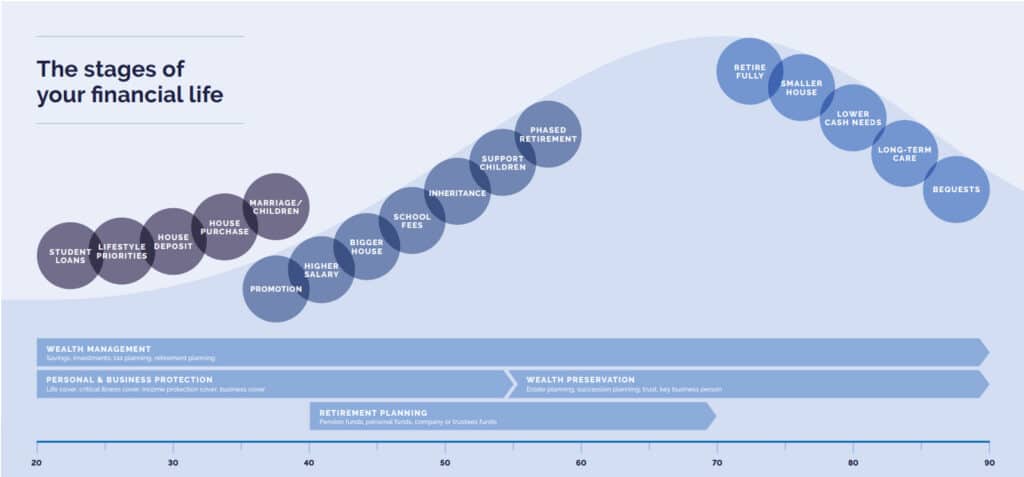

Life isn’t a straight line. It’s filled with exciting milestones and unexpected events, both of which can impact your financial future.

At Lazenby’s, a leading financial advisor in Leeds, we believe that financial planning should go beyond just saving for retirement. We offer Life Stage Planning – a personalised financial plan to help you navigate the twists and turns of life, ensuring you’re financially prepared for whatever life throws your way.

Our Life Stage Planning service caters to your unique goals and needs at every step:

- Financial Planning for Young Adults: Managing student loans, saving for a house deposit, planning for marriage or starting a family.

- Financial Planning for Mid-Life: Growing your wealth for a secure future, financing education for children, navigating career changes or inheritances.

- Retirement Planning: Transitioning smoothly to a comfortable retirement lifestyle, managing healthcare costs and planning for your legacy.

Data Driven Planning for Real Results

We use advanced cash flow modelling software to create a clear and realistic picture of your financial future. This software offers several benefits:

- Personalised Action Plan: We analyse your income and expenses to create a financial planning plan tailored to your unique situation.

- Life Event Modelling: We factor in potential future events like holidays, education costs, inheritances and long-term care needs.

- Adaptable Strategy: Your financial life is dynamic. Our software allows for easy adjustments to your plan as your circumstances evolve.

- Financial Goal Visualisation: Our software provides easy-to-understand graphs and charts illustrating your financial progress.

- Stress Test Your Portfolio: We can model how various scenarios, like early retirement or unexpected expenses could impact your financial security.

Benefits of Lazenby's Life Stage Financial Planning:

Clarity and Confidence: Gain a deeper understanding of your current and future financial standing, empowering you to make informed decisions.

Financial Security: Build a roadmap to achieve your financial goals and ensure a secure future for yourself and your family.

Peace of Mind: Eliminate financial anxieties and enjoy life’s journey knowing you’re on track.

Flexibility: Easily adapt your plan to life’s unforeseen events, maintaining control over your financial future.

Financial Planning FAQs

Financial planning is a personalised process that helps you achieve your financial goals. It involves creating a roadmap for your financial future, considering your income, expenses, savings, investments, and retirement needs. Financial planning can help you:

Build wealth: Develop strategies to save and invest for your future goals.

Manage debt: Create a plan to pay off debt and improve your financial health.

Prepare for retirement: Ensure you have enough savings to live comfortably in retirement.

Protect your assets: Plan for unexpected events like illness or disability.

Achieve financial peace of mind: Gain control of your finances and feel more secure about your future.

Financial planning can be complex, and a financial planner can provide valuable guidance and expertise. They can help you assess your financial situation, develop a personalised plan, and make informed decisions about your money. A financial planner can be especially helpful if you:

- Have complex financial goals.

- Are approaching retirement.

- Have recently experienced a life change (marriage, inheritance, etc.).

- Feel overwhelmed by your finances.

Financial advisors can offer investment advice and sell financial products. Financial planners, on the other hand, take a more holistic approach, considering all aspects of your financial life and creating a comprehensive plan to achieve your goals. Some financial planners may also be licensed financial advisors and be able to offer investment products.

Financial planning fees can vary depending on the complexity of your situation and the services provided. Some advisors charge an hourly rate, a retainer fee, or a percentage of your assets under management. We offer a free consultation to discuss your needs and explain our fee structure in detail.

At Lazenby’s, we take the time to understand your unique financial situation, goals, and risk tolerance. We work collaboratively with you to develop a personalised plan that aligns with your needs. We provide ongoing support and regularly review your plan to ensure it remains on track as your life circumstances evolve.

Schedule a free consultation with one of our experienced financial advisors. During the consultation, you can discuss your financial goals and learn more about how we can help you achieve them.

Contact an IFA Today

Contact Lazenby’s to schedule your free consultation and learn more about our Life Stage Planning service.

NB: The value of pensions and investments and the income they produce can fall as well as rise. You may get back less than you invested. Past performance is no indicator of future performance, and investments can go down as well as