In my profession we have many interesting phrases from Dirty and Clean share pricing to pound cost averaging. The latest is pound cost ravaging!

This has come about by the move to pension freedoms with so many people doing their own drawdown pensions instead of using annuities.

Now this is a hot topic and a big one, so I will briefly touch on it here. When you take an income in retirement from your pension in the form of Drawdown (that’s taking a withdrawal directly from your pension pot) you move from what’s called the Accumulation phase, where you build up your assets, to the Decumalation phase, where you take your income to fund your standard of living in retirement.

When you were accumulating your assets you weren’t happy seeing them go down but you thought that in the long run it would all work out. When you are decumalating your wealth the risks have actually increased a great deal! If you thought investing was risky, and it is, then wait until you need to take an income from your investments.

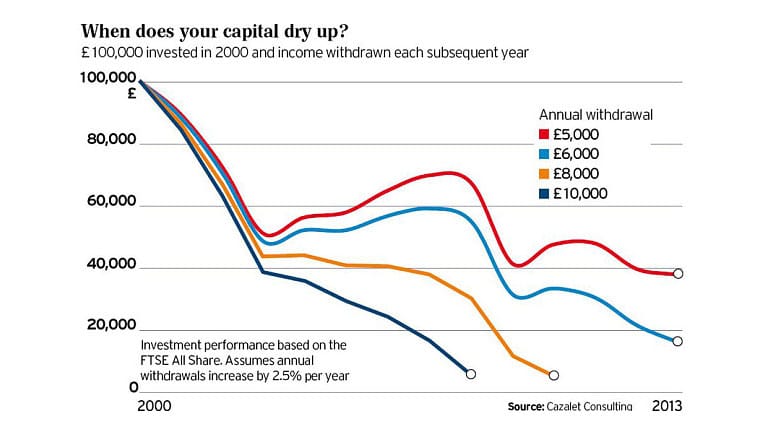

The problem arises from taking an income. Let’s consider the large falls in the FTSE 100 recently during the crisis in China. At certain points the FTSE 100 fell by over 10% and in fact as I write it’s still down compared to last year. Now imagine you need to take an income from your investment just as the market falls and you have invested in a FTSE 100 Tracker because it’s cheap and you get an income yield of over 3% a year. You have sold down part of your investment to pay yourself an income just at the moment the market fell, and you do this every month because you need a monthly income. If you took 6% over the course of a year, so 0.5% per month you will have less available for an income the following month because the fund fell 10% that month and you added to its misery by taking an income from it when it fell. Now imagine a full year of volatility and no growth in that year at all, but you have taken 6% out based on 0.5% every month. We call that pound cost ravaging!

You don’t just have the risk of investing now, but of taking an income from an investment. A great deal of care is needed to ensure you don’t run out of money before you die.

Are you being ravaged, but not in a good way?

I am not advising you to use any products mentioned here, nor am I making a specific recommendation. The value of pensions and investments can fall as well as rise. You may get back less than you invested.